Investor Relations

Financials

Half Year Financial Statement And Dividend Announcement 2021

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Financial Statements

For the six months ended 30 June 2021

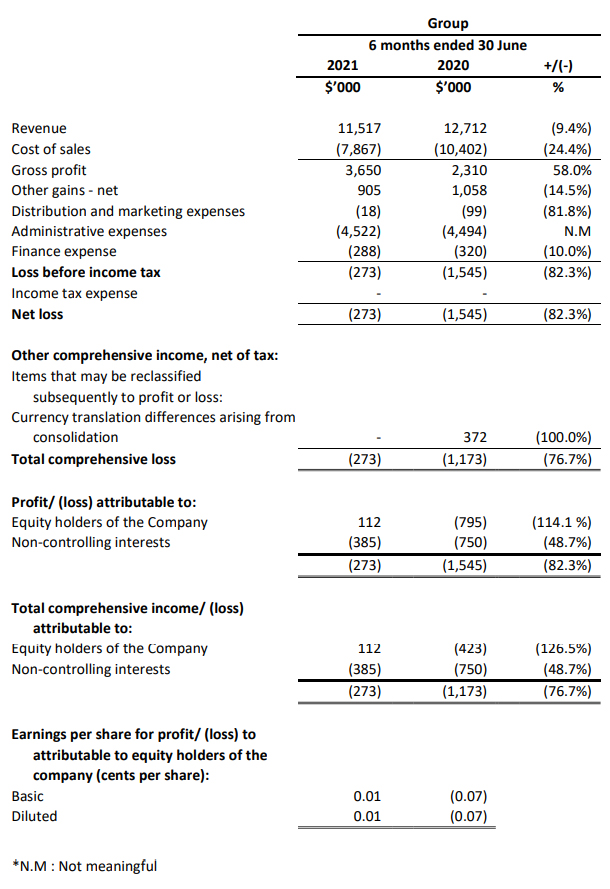

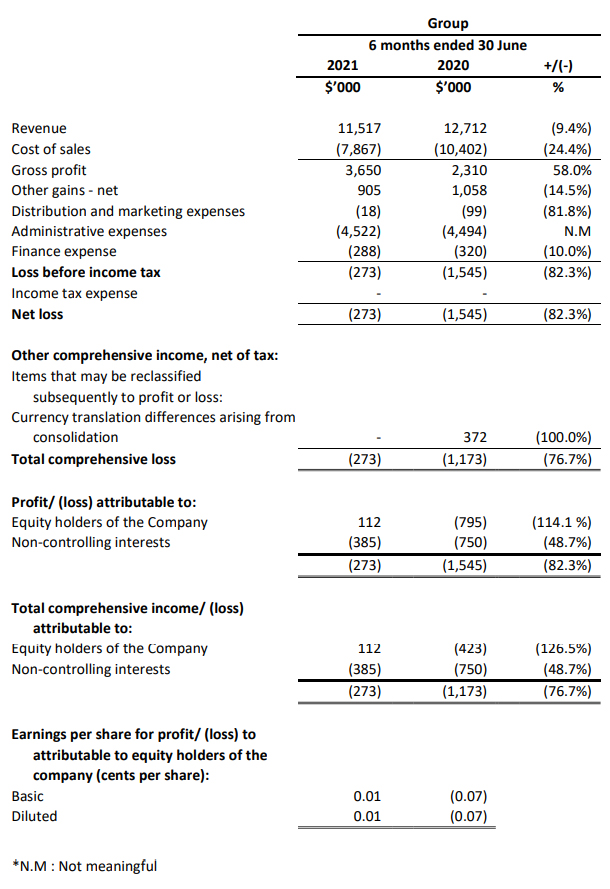

Profit and Loss

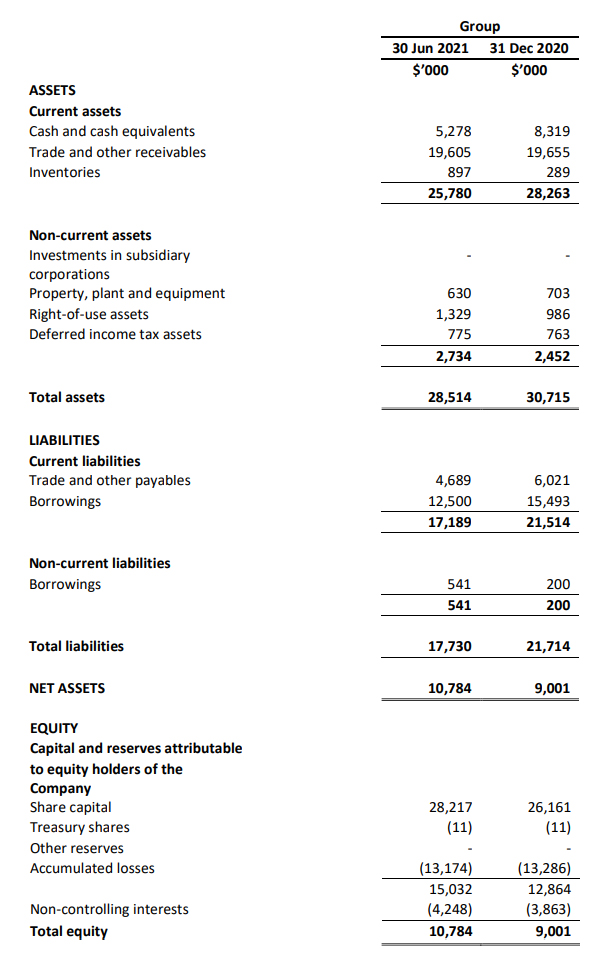

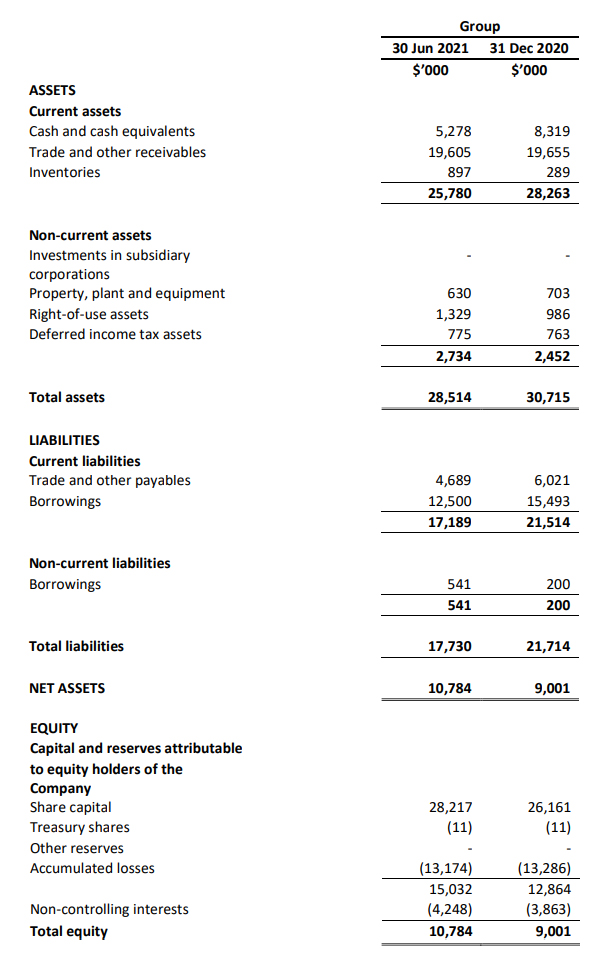

Balance Sheet

Review of Performance

Overview

The Group posted a revenue of S$11.5 million for the six months ended 30 June 2021 (“HY2021”) representing

a decrease of 9.4% or S$1.2 million from S$12.7 million recorded in the previous corresponding period (“HY2020”).

The Group posted a gross profit of S$3.7 million in HY2021, representing an increase of 58.0% from S$2.3 million

reported in HY2020. This is a result of better management of project cost.

Overall, the Group made some improvement from a net loss of S$1.5 million in HY2020 to a lower net loss of

S$0.3 million in HY2021 despite the decrease in revenue. Before taking into consideration non-controlling

interests, net profit attributable to equity holders of the Company is S$0.1 million in HY2021 compared to a net

loss of S$0.8million in HY2020.

Revenue

The Group’s revenue decreased 9.4% to S$11.5 million in HY2021. The decrease in revenue in the Project Sales

segment was the main driver in this overall decrease in revenue, and was partially offset by increased revenue from the Project Management and Maintenance Services segment.

Project Sales showed a decline of 62.8% from S$3.5 million in HY2020 to S$1.3 million in HY2021 mainly due to:

- Local markets – delays in the implementation of various projects as a result of the Covid-19 pandemic.

These delays are mainly due to restrictions in the movement of workers and customers not being

allowed us to access their premises. - Overseas markets – most of the countries’ borders in our overseas market remain closed as a result of

the governments’ implementation of measures to restrict the spread of Covid-19, which has caused

the revenue generated from these markets to have decreased substantially.

Revenue in Project Management and Maintenance Services increased by 11.1% or S$1.0 million from S$9.2 million in HY2020 to S$10.2 million in HY2021. Our work force comprising of generally foreign workers gradually obtained clearance from Ministry of Manpower to resume work from the end of 2020 to the earlier part of HY2021 which led to being able to complete outstanding works on hand and realize more revenue in the earlier part of HY2021. However, there was subsequently a slowdown in the completion of works for May and June 2021 due to tighter controls implemented by the authorities as a result of the increased Covid-19 cases.

Profitability

Despite generating a lower revenue, the Group posted a gross profit of S$3.7 million in HY2021, representing an increase of 58.0% or S$1.4 million from S$2.3 million reported in HY2020.

Gross profit from Project Sales slightly decreased by 9.9% or S$61,000 in HY2021 from S$0.61 million in HY2020 to S$0.6 million in HY2021. Gross profit from Project Management and Maintenance Services increased by 82.5% or S$1.4 million from S$1.7 million in HY2020 to S$3.1 million in HY2021.

The Group made an improvement from a net loss of S$1.5 million in HY2020 to a lower net loss of S0.3 million in HY2021 after taking into consideration the following:

- Reduction in the cost of sales of 24.4% or S$2.5 million from S$10.4 million in HY2020 to S$7.9 million in HY2021 due mainly to the reduction of direct workers;

- Lower distribution and marketing expense by 81.8% or S$81,000 from S$99,000 in HY2020 to S$18,000 in HY2021 mainly due to restriction in traveling due to many countries’ borders being closed;

- Lower finance expenses by 10.0% or S$32,000 from S$320,000 in HY2020 to S$288,000 in HY2021 due to a reduction in borrowings;

- Decrease in other gains – net by 14.5% or S$0.2 million from S$1.1 million in HY2020 to S$0.9 million in HY2021. The reduction in other gains is due mainly to the reduction in government assistance as compared to the previous corresponding period; and

- Slight increase in administrative expenses by 0.6% or S$28,000

Before taking into consideration non-controlling interests, net profit attributable to equity holders of the Company is S$0.1 million in HY2021 compared to a net loss of S$0.8million in HY2020.

Financial Position

Assets

Cash and cash equivalents decreased from S$8.3 million as at 31 December 2020 to S$5.3 million as at 30 June 2021 as a result of the repayment of borrowings and payment of trade and other payables.

Trade and other receivables decreased by S$0.1 million from S$19.7 million as at 31 December 2020 to S$19.6 million as at 30 June 2021, attributable to the collections of payment from customers which are in line with the payment terms that we provide to our customers.

Inventories increased by S$0.6 million from S$0.3 million as at 31 December 2020 to S$0.9 million as at 30 June 2021. The significant increase was mainly due to the purchase of materials for projects and work-in-progress. The increase in property, plant and equipment and Right-of-use assets of $0.3 million was mainly due to:

- Purchase of Property, plant and equipment of S$0.1 million;

- New or renewal of leases to Right-of-use assets of S$0.9 million; offset by

- Depreciation of Property, plant and equipment of S$0.2 million

- Depreciation of Right-of-use assets S$0.5 million

Liabilities

Trade and other payables decreased by S$1.3 million from S$6.0 million as at 31 December 2020 to S$4.7 million as at 30 June 2021. This is in accordance to agreed payment terms for creditors.

Current borrowings decreased by S$3 million from S$15.5 million as at 31 December 2020 to S$12.5 million as at 30 June 2021. This is a result of repayment of the Group’s borrowings from financial institutions for working

capital and projects financing.

Non-current borrowings increased by S$0.3 million from S$0.2 million as at 31 December 2020 to S$0.5 million as at 30 June 2021 This is due to an increase in finance leases obtained by the Group.

Cash flow

The Group recorded cash and cash equivalents of S$5.3 million at the end of HY2021. This was a decrease of S$3.0 million from S$8.3 million as at the end of FY2020.

The Group’s net cash used in operating activities in HY2021 was S$1.2 million, mainly due to purchase of materials for projects and work-in-progress. Operating cash flow before working capital changes of S$1.2 million was mainly offset by changes in inventories of S$0.6 million, changes in trade and other receivables of S$50,000 and changes in trade and other payables of S$1.9 million.

The Group’s net cash used in investing activities in HY2021 was S$19,000 for the purchase of property, plant and equipment.

The Group’s net cash used in financing activities in HY2021 amounted to S$0.7 million as compared to S$4.3 million of net cash provided by financing activities in HY2020. The net cash used in financing activities in HY2021 was due to proceeds from the issuance of ordinary shares of S$2.1 million and which was offset by:

- Bank deposits pledged of S$0.3 million;

- Repayment of borrowings of S$1.8 million;

- Repayment of finance lease liabilities of S$0.5 million; and

- payment of interest of S$0.1 million.

Commentary

The outstanding order book (contracts signed) as at 30 June 2021 is S$65.9 million. The majority of the Group’s outstanding order book is in Singapore, the Group’s key market.

The Regional and Global economic forecasts still remain very negative. Although there has been an improvement in the Group’s performance in the 1st half of the financial year ended 30 June 2021 as compared to the previous corresponding period, the Group had been adversely affected by the pandemic in HY2021 and this impact on our operations may continue to last in the next 12 months, subject to the Covid-19 situation and the government’s implementation of measures, if any, to control the spread of Covid-19.

The Group however saw improvements in the Covid-19 situation in Singapore since its entry into the Preparatory Stage of a four-stage plan to live with Covid-19 since 10 August 2021 and the Group is hence seeing improvements in its Singapore operations compared to the last financial year ended 31 December 2020. While we hope that there will not be any more new “covid waves”, many uncertainties remain in the countries we operate in. While the Group will continue to monitor the recent increase in cases globally, it is clear that the impact of the Covid-19 pandemic on our businesses will continue to last much longer than we had hoped.

The Company had on 6 August 2021 received a letter of statutory demand (“Letter of Statutory Demand”) from the Company’s previous sponsor, Asian Corporate Advisors Pte. Ltd. (the “Previous Sponsor”) (as announced on 11 August 2021) in relation to the work alleged to be done by the Previous Sponsor as set out in their invoices.

As at 30 June 2021, the Company has cash and cash equivalents of S$5.28 million. As such, the Company has the capacity to make immediate payment for the Alleged Fees if the fees charged are agreeable.

The Letter of Statutory Demand or the full payment of the amount in dispute, is not expected to materially impact the financial position of the Group for the current financial year ending 31 December 2021.